Monte Carlo for financial services.

Make your data quality as stringent as your industry regulations.

Trusted by the data teams at

Clearcover increased data quality coverage by 70 percent.

Data stack

70%

Increase in data quality coverage.

50%

Faster resolution times.

Challenge

- Rising data volumes stemming from business applications and departments.

- Lack of domain knowledge into department-specific data sources.

- Complexity associated with their growing data stack implementations.

Solution

- Reduced implementation times with out of the box coverage for new datasets.

- Automated data lineage creation to isolate and remediate incidents.

- Custom field health thresholds to meet internal SLAs.

“We no longer have to tailor specific tests to every particular data asset. All we really had to do was sign up, add the security implementation to give Monte Carlo the access that it needed, and we were able to start getting alerted on issues. Monte Carlo gave us that right out of the box.”

Braun Reyes Former Senior Manager of Data Engineering

Use cases for financial technologies.

Achieve data integrity.

Make sure that third-party data is tagged and classified appropriately.

Scale proactive incident resolution.

One inaccurate field can have detrimental effects. Invest in a data quality solution that alerts you before incidents occur.

Increase customer engagement.

Leverage application data to improve the user experience at each stage of the customer journey.

Use cases for financial services and insurance.

Make accurate decisions.

Ensure your consumers are ingesting reliable data to drive financial decision making.

Remove the risk from risk management.

You have models to understand where risks are in your portfolio, but you need to know where risks exist in your data, too.

Ensure data compliance.

Ensure your service is industry-compliant with accurate data to avoid costly fines and reputational damage.

“Monte Carlo is a very good way for us to understand our data quality at scale.”

Trish Pham Head of Analytics

Out-of-the-box coverage across all your data tables, opt-in monitors for key assets, and monitors-as-code.

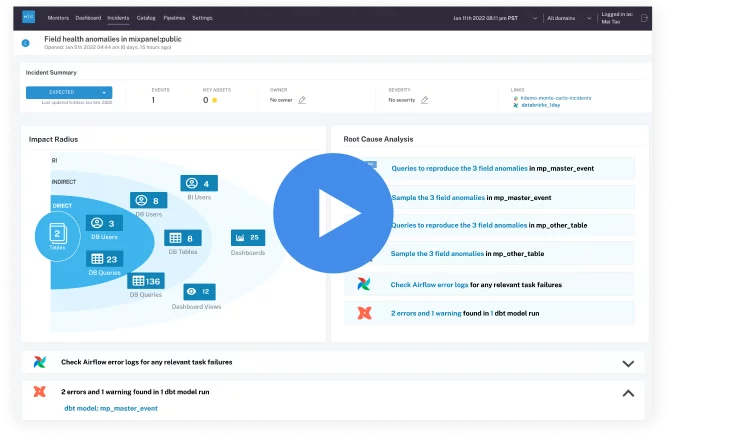

Don’t just sound the alarm when data incidents occur. Empower your data teams to resolve incidents in minutes.

Rich insights enable your team to proactively ensure data quality, and make better infrastructure investment decisions.

Product demo.

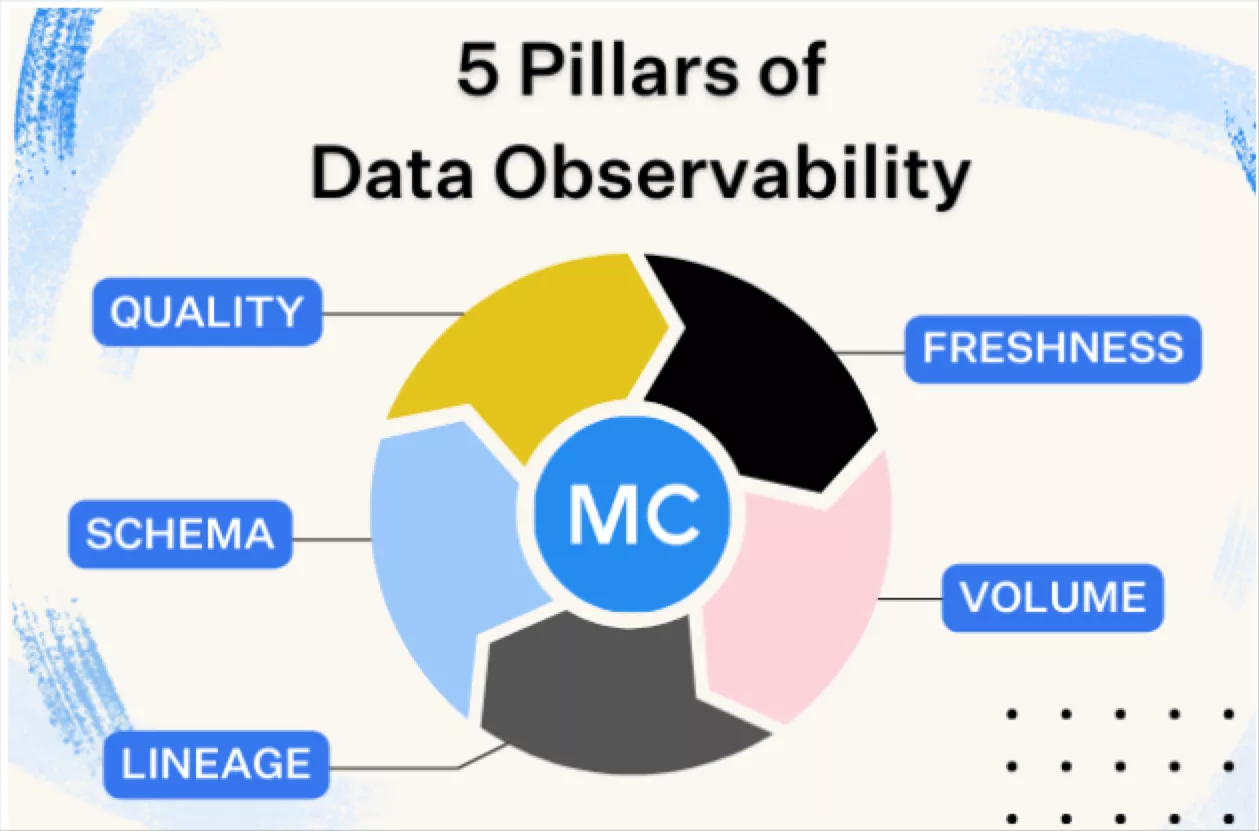

Product demo.  What is data observability?

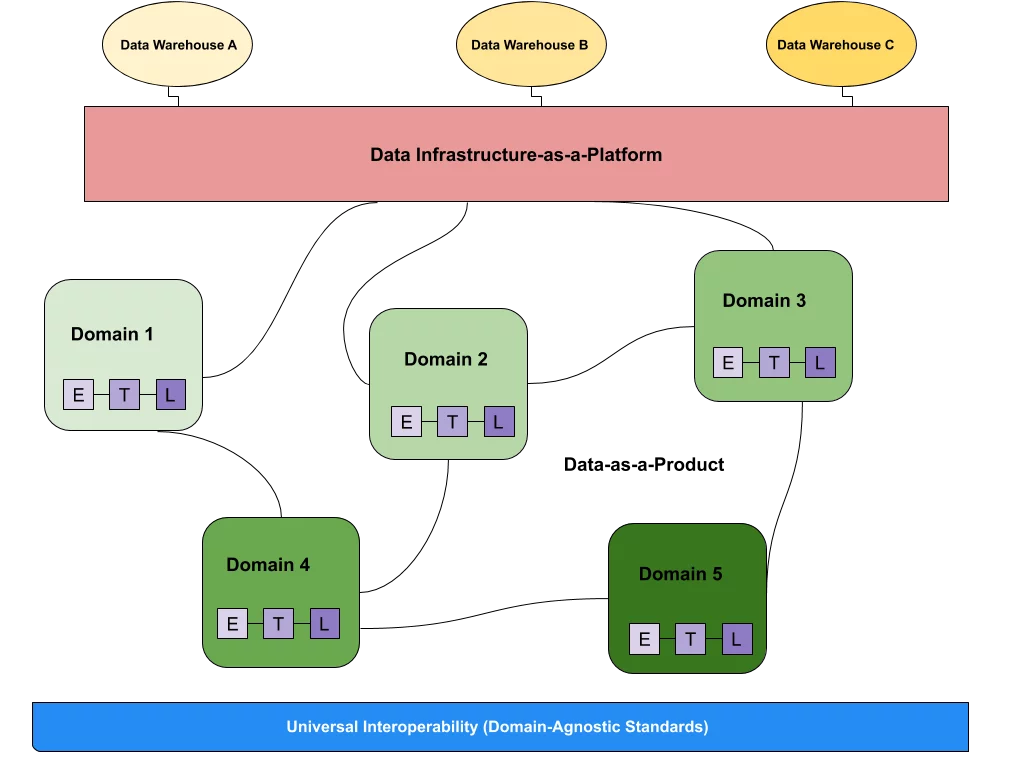

What is data observability?  What is a data mesh--and how not to mesh it up

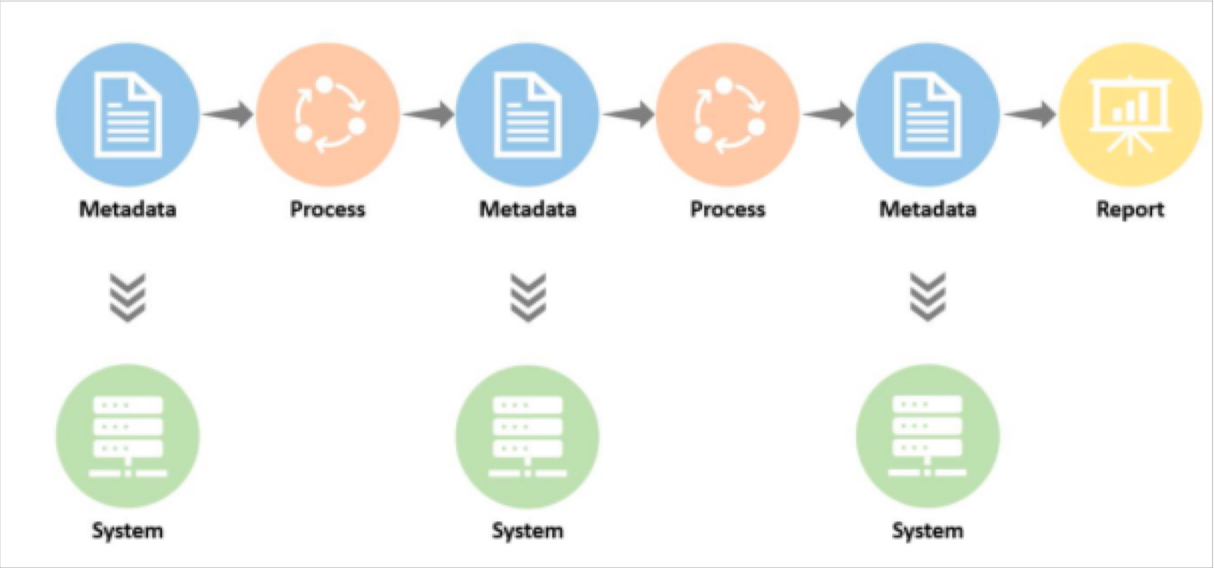

What is a data mesh--and how not to mesh it up  The ULTIMATE Guide To Data Lineage

The ULTIMATE Guide To Data Lineage