How Data and Finance Teams Can Be Friends (And Stop Being Frenemies)

Recently I wrote an article about data silos that form across the organization, often due to lack of alignment with partners. This alignment can be difficult to come by, but is crucial to a data leader’s success.

With the range of internal customers to support, it can be tempting for data teams to inhabit the principles of an assembly line or even a fry cook at McDonalds. Everyone gets the same cheeseburger with exactly two pickles. Order up.

But the best data teams are able to inhabit the problem space of different partners (finance, product, marketing, etc), meeting them where they are with tailored data products that go beyond the generic, off-the-shelf solutions.

This is the first post in what is intended to be a series on best practices for working with each department, and all their wonderful eccentricities. We’ll start with the finance team, diving into how data teams can collaborate with them where priorities intersect.

Projects that will win over your finance team

Here I’ll focus predominantly on strategic finance or FP&A projects such as blending financial and non-financial metrics to inform business growth; strategy; and investment. This is where I see the bulk of project collaborations with finance teams.

Financial accounting (e.g. tax, payroll), on the other hand, tends to exist in a set of systems largely outside of the data platform – and that’s OK.

Financial reporting

If you are a public company or approaching an IPO, chances are the data team will partner with finance to deliver quarterly reporting to Wall Street and accompanying data for earnings calls.

To enable this reporting, the data team will manage complex pipelines that transform transactional data from commerce systems into customer-level data detailing the specific customer relationship or products purchased, and the associated revenue.

The finance team will be focused on reliability above all else; no CFO wants to restate quarterly earnings. I’ve found this is one of the few places where accuracy can be precisely measured, using the general ledger as a source-of-truth. The finance team will have high standards for accuracy as they are accountable up to the penny on their regular reporting – expect their standards for analytical data supporting their team to be no less.

How timely should the data be? Ideally the same data can be queried and used for financial analytics and reporting on a daily basis. But it’s best to prioritize accuracy over timeliness, potentially offering separate real-time views of sales that don’t require the same accuracy-to-the-penny.

By extension, the CFO will be focused on related data in the earnings report that may drive the business growth, such as the daily active users (DAUs), app downloads, or views. Accuracy is often more subjective here – relying on the definitions you give to “users,” “active,” and “views.” The definition must be clear and defensible, and critically consistent over time, so that you can be confident in period-over-period trends. In other words, the data should (at least) be directionally accurate.

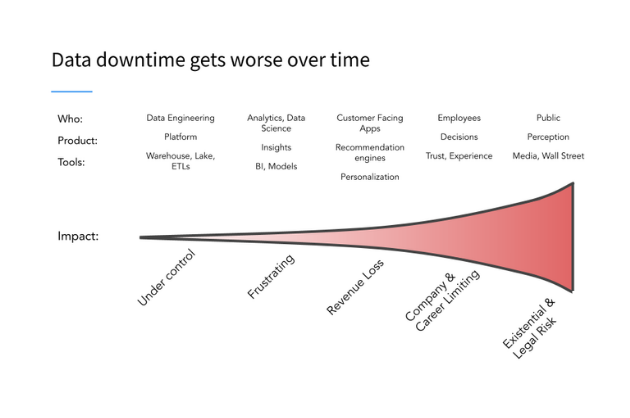

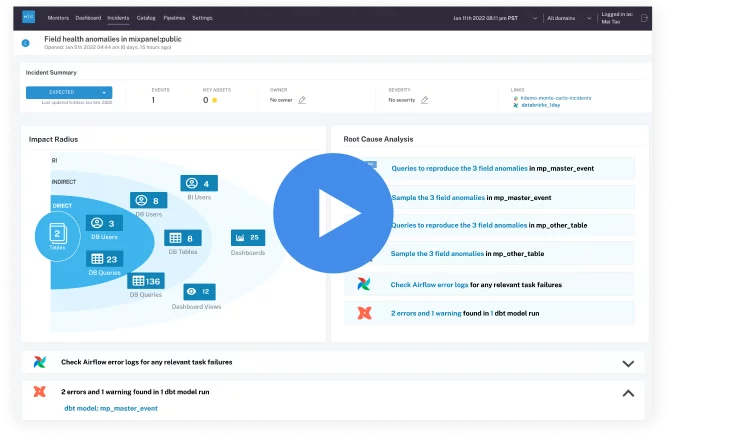

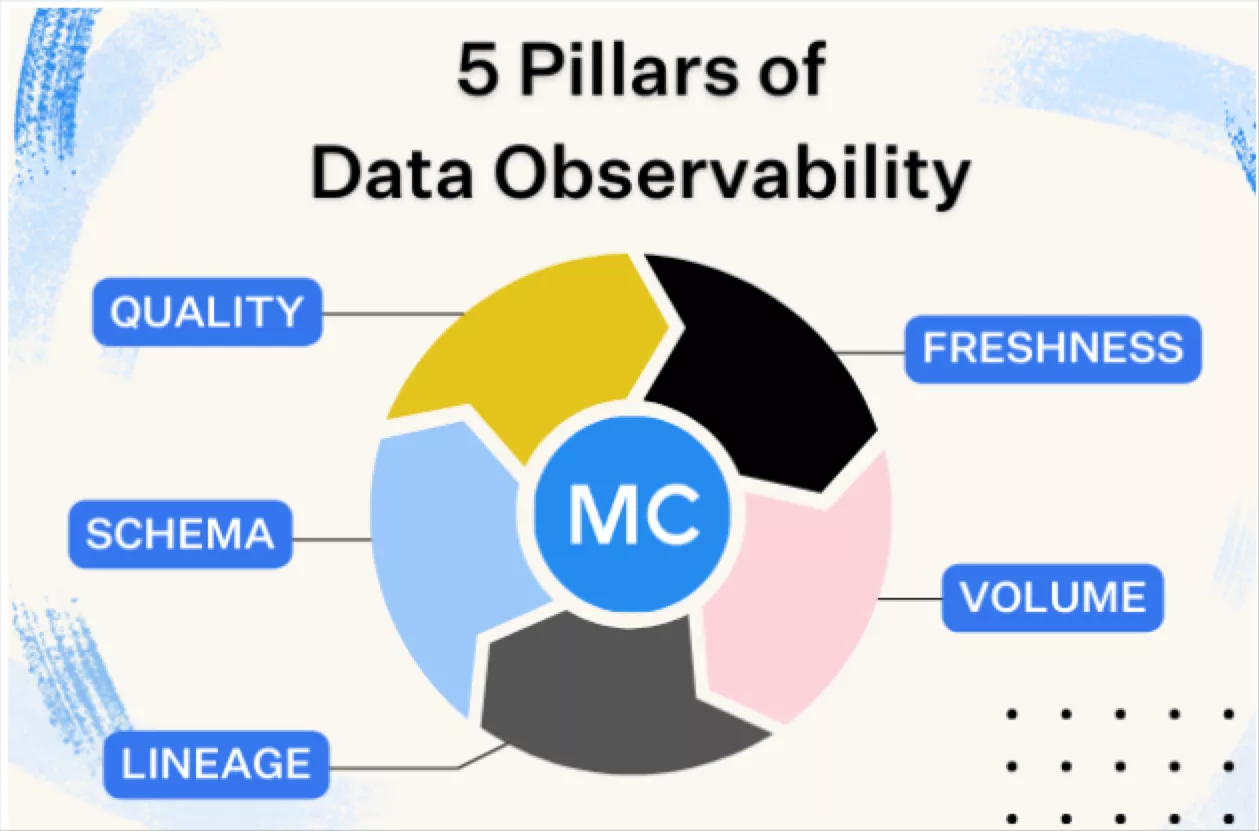

It goes without saying that data observability is critical for these metrics. You must proactively detect any shifts in the nature of the input data that could affect the integrity of your outputs. Turnaround times at the end of the quarter are tight, you don’t want to be discovering data issues as these reports are compiled and delivered.

Forecasts and growth-driver modeling

Finance teams live-and-breathe forecasts. Once data teams are supporting financial reporting, the next logical step is to partner on forecasts for future quarters – sales, new customers acquired, customer churn.

Data teams can provide expertise on the right modeling method, but you may find that simpler, empirical methods are preferred by your finance colleagues over a more precise but less explainable model, allowing them to more readily adjust assumptions, inputs and model parameters.

When a forecast is missed, you’ll want to be able to quickly diagnose the contributing reasons and produce the much-loved waterfall chart. The reason these charts are so effective is that they can communicate different types of uncertainty in the forecast, such as variance due to the environment, variance due to customer behavior, and unexplainable or random variance.

While forecasting is an operating mechanism, its strategic counterpart is the modeling of growth drivers. Data teams should take the lead on modeling exercises to explore the most important product and marketing levers that correlate with growth (i.e. customer acquisition & retention).

While these models are historical in nature, when done well they will hint at causal relationships. For example, analysis may show that I’m more likely to retain my Spotify subscription if I listen to many different genres of music, but is this a behavior Spotify can influence through interventions in the product experience to increase my engagement and likelihood to retain?

Pairing these models with subsequent product experiments can solidify this causal relationship. Using the example above, Spotify may experiment with the genre diversity of discovery algorithms in order to see whether customers like me increase their engagement and retention when algorithmic programming is more genre-diverse.

For the finance team, these models can be particularly useful in plotting out longer-term growth scenarios for the business, informing how to set targets for product and marketing metrics that ladder up to the growth targets.

Marketing Attribution and Mix

Typically, when it comes to questions of marketing spend, you’ll encounter a triumvirate of marketing (determine where and how to spend money), finance (determine the budget and profitability), and data (determine how to measure the ROI on spend).

Are data teams still attempting to deliver multi-touch attribution, or has this become a non-starter given the platform “walled gardens” and demise of the third-party cookie? I’ve seen data teams chase a holy grail of perfect attribution at the behest of executives, only to fall short due tracking limitations.

Marketing mix modeling (MMM) has always been my preferred approach to questions of spend, channel mix and ROI, using time-series models to deliver a holistic view of digital and non-digital marketing channels, accounting for incremental sales over-and-above the base that would be expected if marketing spend were removed from the equation.

Then, you can focus on individual customer attribution within each marketing channel in order to optimize the specific offers and messaging, without attempting to track customers across multiple external channels.

Pricing, Offers & Lifetime Value (LTV)

Somewhere between the marketing and finance teams sits the crucial pricing decisions – what are the price-points for different products, what discounts can be profitably offered, and when do you increase prices on existing customers?

An early partnership might be around pricing experiments, moving these decisions from the realm of executive guessing to a series of pricing experiments, where success is measured beyond the initial sale to account for customer retention and lifetime value (LTV).

Typically, this LTV metric will be modeled by the finance team on specific campaigns or cohorts of customers, based on aggregated assumptions of customer retention. As you solidify the partnership, a high impact project for the data team is to move the measurement of LTV from the campaign or cohort level to the individual customer level, incorporating what you know about customer behavior that influences churn and upsell.

Then these LTV scores can live within the data warehouse and be readily applied to future experiments and analyses. Once they see the granularity with which you can measure their pricing strategies, finance teams will return with more hypotheses to be tested.

Tips for success in working with finance teams

The finance team can be one of the most strategic partners to the data team. The key is to understand their existential need for data accuracy, how this need affects project delivery expectations, how to best enrich data from their systems of record and, in doing so, how to partner with them on transformative data projects. Remember:

- Accuracy and consistency are paramount – Financial metrics must meet a high standard of accuracy, and non-financial metrics must be consistent over time, to be useful in financial modeling and reporting.

- Requirements gathering is critical – You may need to bend your agile principles in favor of something closer to a waterfall approach, given that launch cannot happen until data reliability criteria are met.

- Embedded is better than a hand-off – If you can embed a finance team member in your project, it will dramatically improve the translation of business rules and metric definitions.

- Bring data processing upstream – Excel may have (long ago) increased its row limit to 2^20, but you can handle much heavier workloads in your warehouse and move finance logic from a cohort-level to a customer-level.

- Empirical models may be preferred – Before you go and deliver a black-box model to the finance team to forecast churn, make sure it’ll be useful for them when they need to adjust assumptions week-in, week-out.

Keep these things in mind and you will be fast friends with the finance team.

-shane murray

Curious how data observability can help your team achieve the type of accuracy and reliability that will make you friends with finance? Schedule a time to talk to us using the form below!

Our promise: we will show you the product.

Product demo.

Product demo.  What is data observability?

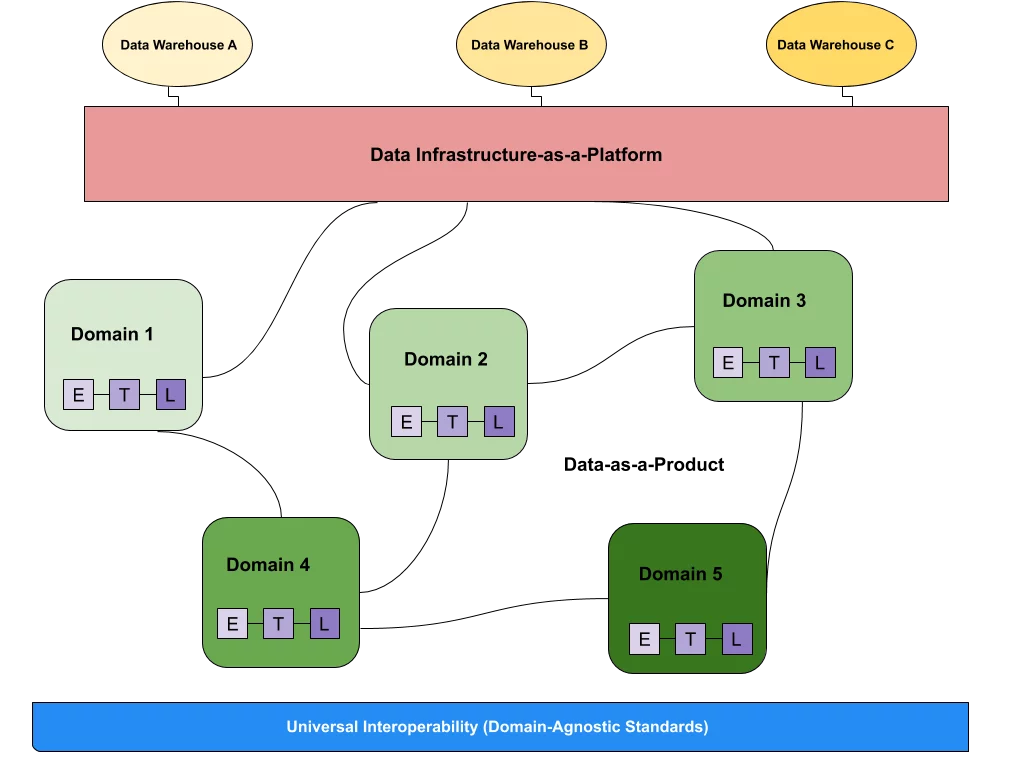

What is data observability?  What is a data mesh--and how not to mesh it up

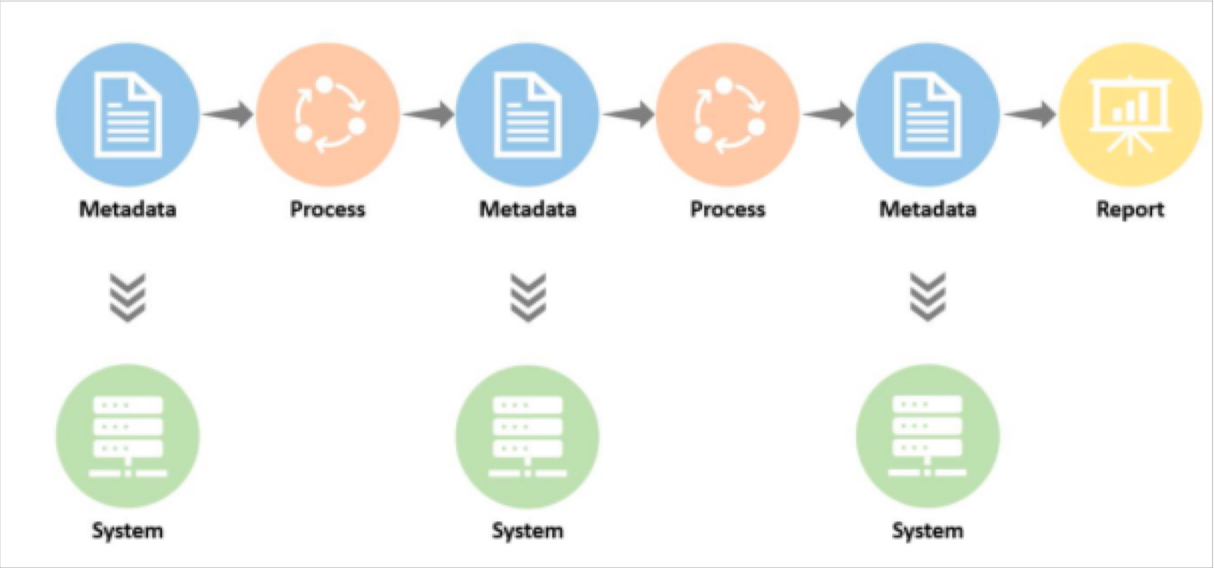

What is a data mesh--and how not to mesh it up  The ULTIMATE Guide To Data Lineage

The ULTIMATE Guide To Data Lineage