What Every Data Team Needs to Know Before You IPO

For decades, finance and legal teams bore the brunt of the work when it came to readying a company for IPO. As pre-IPO companies increasingly rely on data to drive innovation and sharpen their competitive edge, data teams must help chart the course for a public offering, too. Here’s how.

Many folks are wondering these days “What can my data team do to prepare for our company’s IPO?”

While extensive literature exists to support finance teams on their journey to going public, very little has been written to help data teams faced with the same challenge — and that’s a problem.

With companies like Palantir, Snowflake, and Asana listing their public offering in the last few weeks and many more to come (Airbnb and DoorDash, we’re looking at you!), I pooled my network to put together a list of 5 essential steps data organizations need to take to prepare their companies for a successful IPO.

Know where your data lives and who accesses it

According to former members of Uber’s data team, the first job for any data organization in the lead up to your IPO is to audit the data that you’re collecting and storing, as well as who has access to this data (they referred to it as their “Data Blast Radius”).

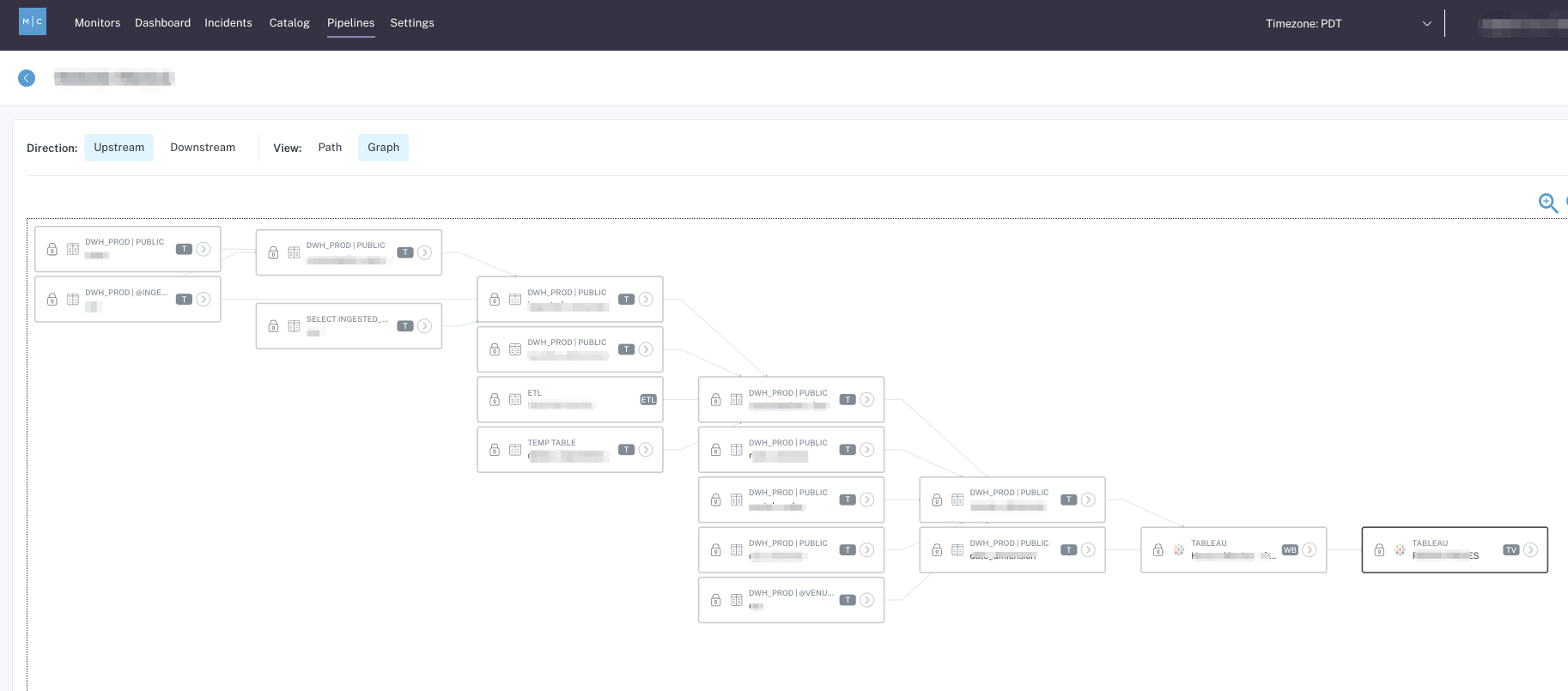

A growing business (AKA, your startup) will rely extensively on the enterprise-level transactional data residing in traditional data warehouse systems; simultaneously, your data team will want to invest in building event streaming and other data platform capabilities, including your company’s operations strategy. Both requirements emphasize the need for a robust and automated data catalog to capture the meaning, location, usage patterns, and owners of your enterprise data.

Partner with your Privacy, Security, & Legal teams early and often

Once you determine who has access to what data, you need to partner with your Privacy, Security, and legal counterparts to determine how to govern data access moving forward. This is important not just for your impending IPO, but also for any company that regularly handles PII or operates in geographic regions that have strict guidance around data usage (consider: GDPR, CCPA, etc.).

Your legal and privacy team will likely be responsible for defining these rules, but you’ll need to build the solutions to ensure that data users abide by them. Together, you’ll need to develop answers to the following questions:

- How long should we be storing data for?

- Who should have access to this data?

- How do I need to change my current data models to adhere to these guidelines?

Pro-tip: where applicable, archive rather than delete outdated but legally significant data to lower cost cold storage.

Lean into data democratization — with guardrails

As you prepare for the IPO, your team is going to need all the help they can get to keep up with the day-to-day data demands of your company. It’s time to invest in some self-service tooling.

One of the most important steps for democratizing data is to invest in data exploration and metadata management, not only for the structured data, but also for unstructured data. Most early stage startups undergoing exponential growth have enormous amounts of internal knowledge about data, so capturing and managing it in a central single source truth (we repeat: a data catalog!) that is explorable is your key to success.

Prioritize fiscal accountability

Public companies must file financial statements on a quarterly and annual basis with the SEC, with prescribed data requirements and adherence to rigorous SEC accounting and disclosure guidelines.

Your company will likely start hiring accountants and financial analysts in droves several years before the IPO process starts in anticipation for the big day; collaborate with their organization early and get their buy-in; it will be easier to collaborate down the road.

Invest in data observability; deliver data reliability

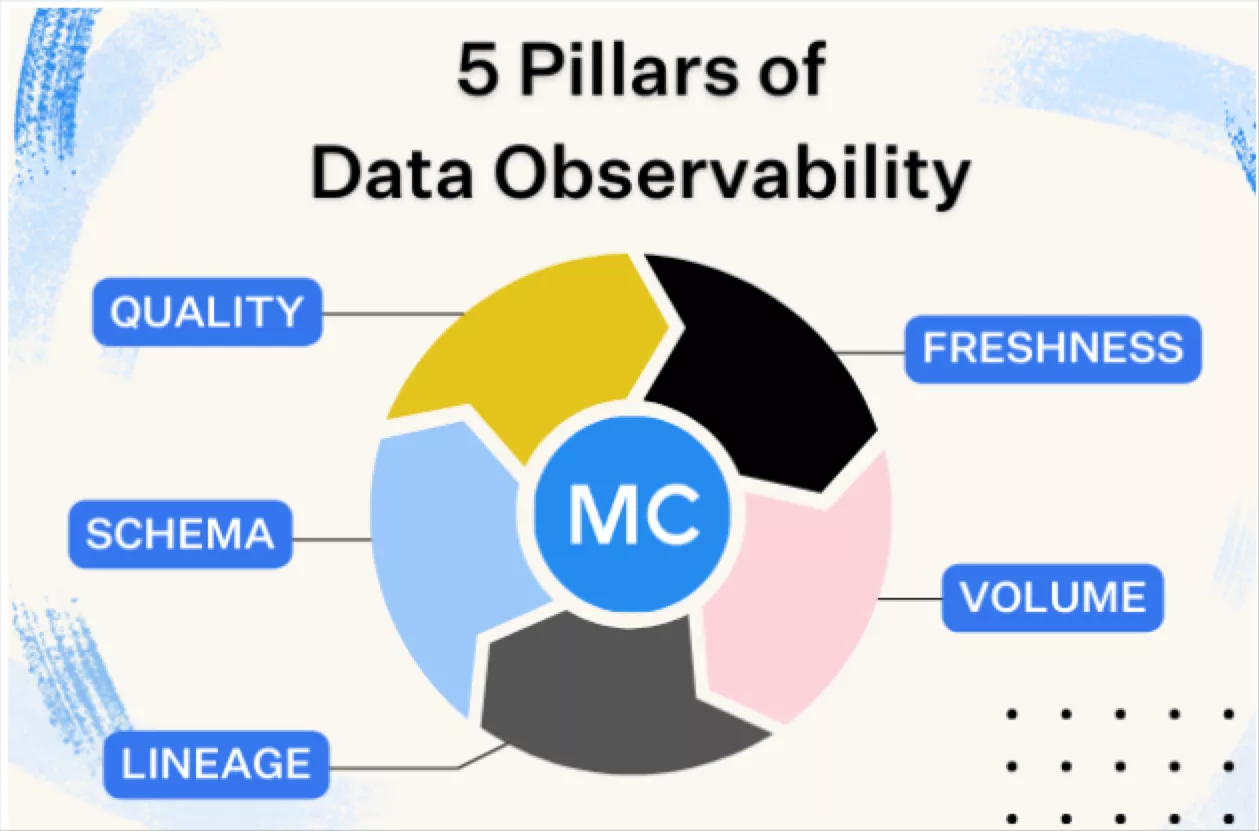

No matter what data guidelines you put in place or analytics solutions you use (Looker anyone?), your data analytics will only be as valuable if your data assets are trustworthy and reliable.

According to PriceWaterhouseCooper, companies “must be prepared to meet the needs and requirements of new external stakeholders, including higher expectations of transparency and data reliability, increased scrutiny of budgets and projections and demands for accelerated filing.”

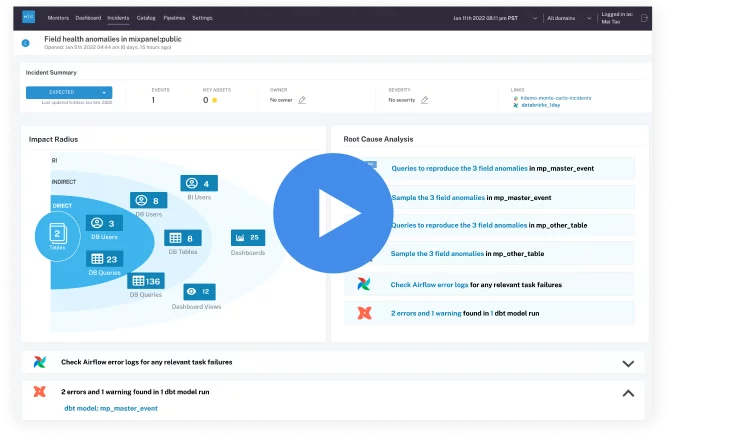

Data teams can ensure data reliability through solutions that provide end-to-end data observability, from ingestion to analytics. Such an approach keeps tabs on where your data lives and who accesses it as well as monitors and alerts for abnormalities in your data. Data reliability solutions provide the best of both worlds by delivering the following benefits, including:

- High data quality, ensuring data governance standards are met

- High data integrity, leading to richer, more accurate insights to move the needle for your business

- Money and time saved to work on data projects that actually generate revenue or otherwise drive innovation for your business

- Trust in your company by the SEC and other governing bodies, not to mention your customers

Here are some additional resources for data teams readying their companies to go public:

- 5 Essential Steps to Prepare for an IPO

- Roadmap for an IPO

- When do data-dependent startups need a Chief Data Officer?

Is your company thinking about data quality? Reach out to Barr Moses or book a time to speak with us using the form below.

Our promise: we will show you the product.

Product demo.

Product demo.  What is data observability?

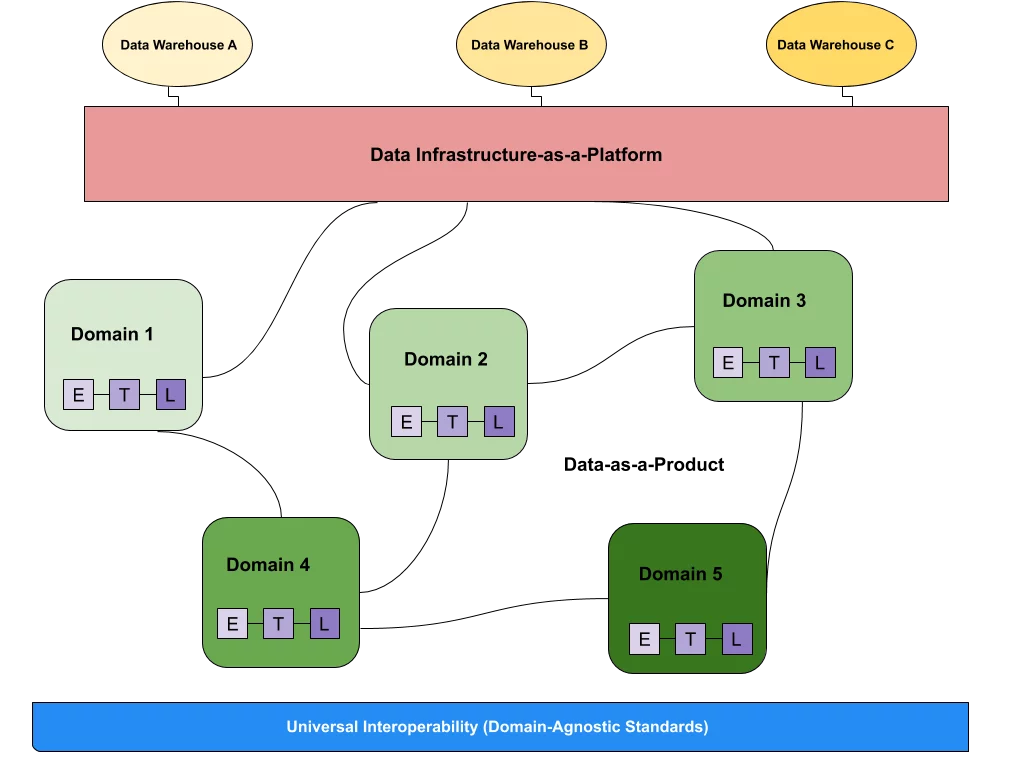

What is data observability?  What is a data mesh--and how not to mesh it up

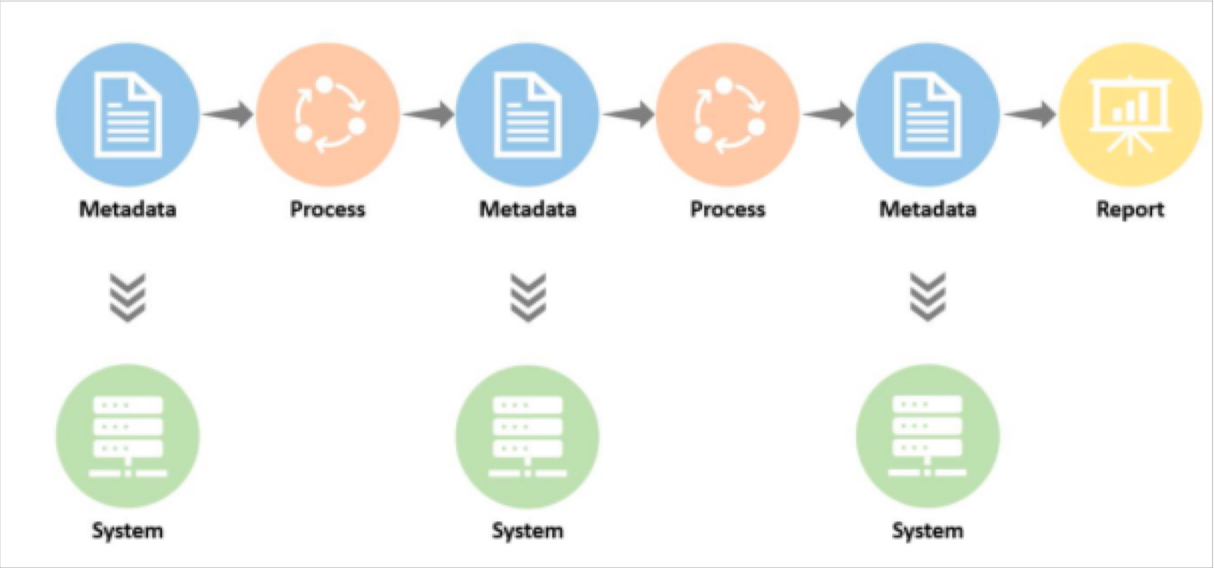

What is a data mesh--and how not to mesh it up  The ULTIMATE Guide To Data Lineage

The ULTIMATE Guide To Data Lineage